Design solution #3

Design solution #3

Design solution #3

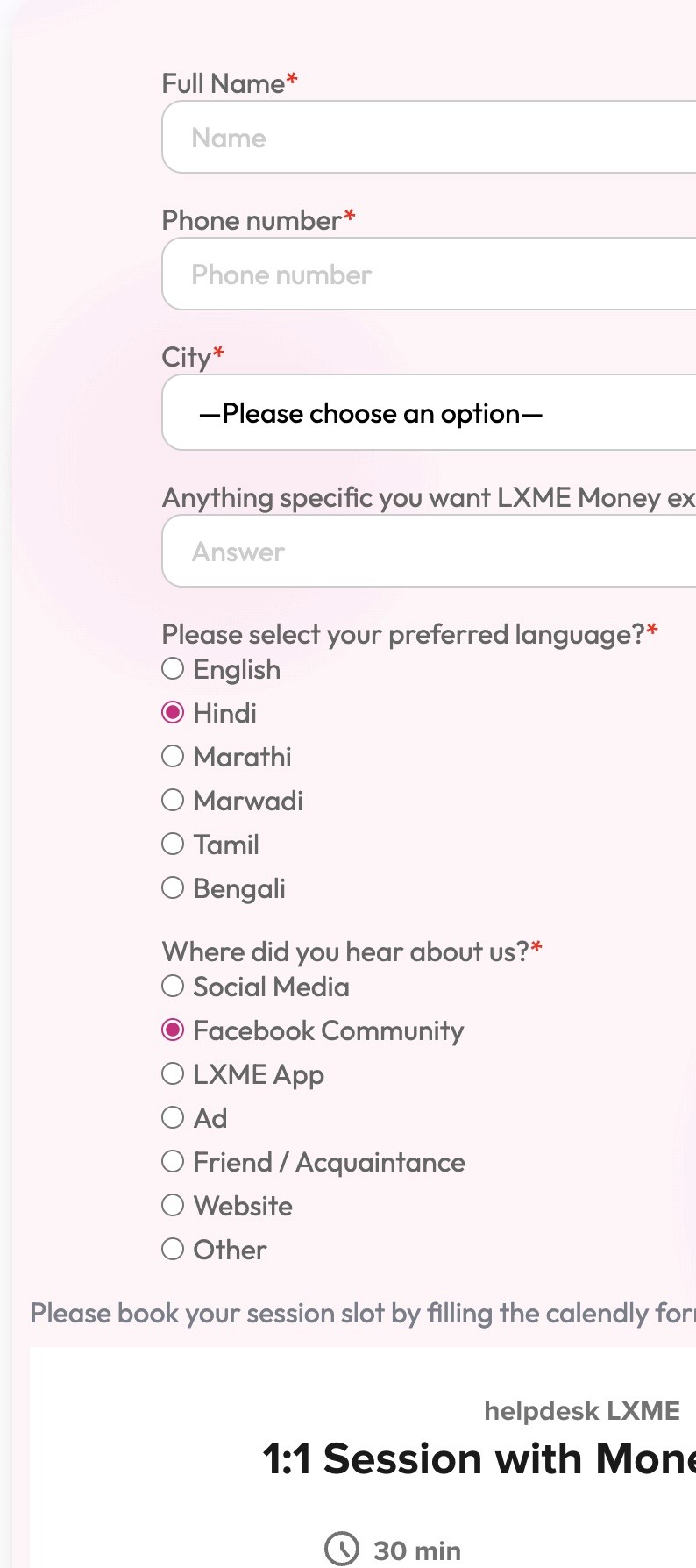

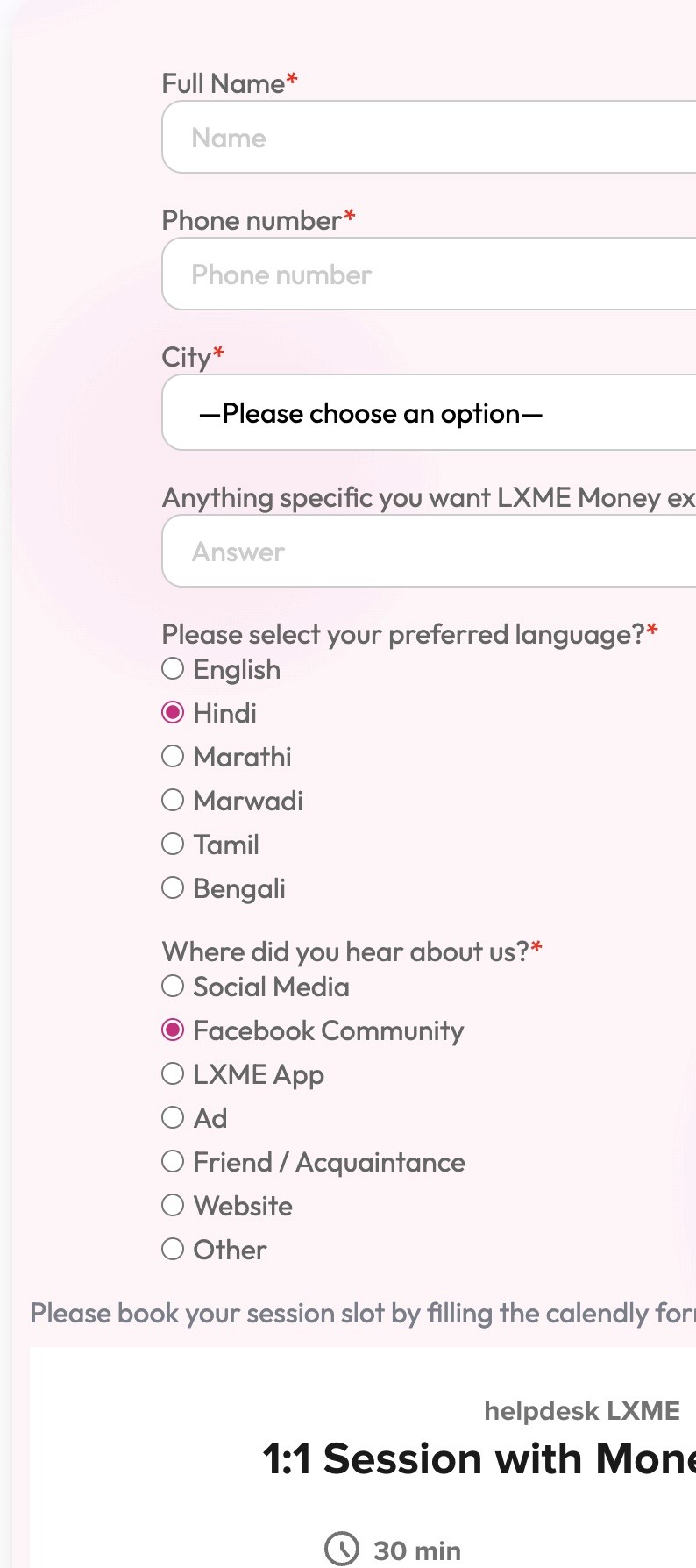

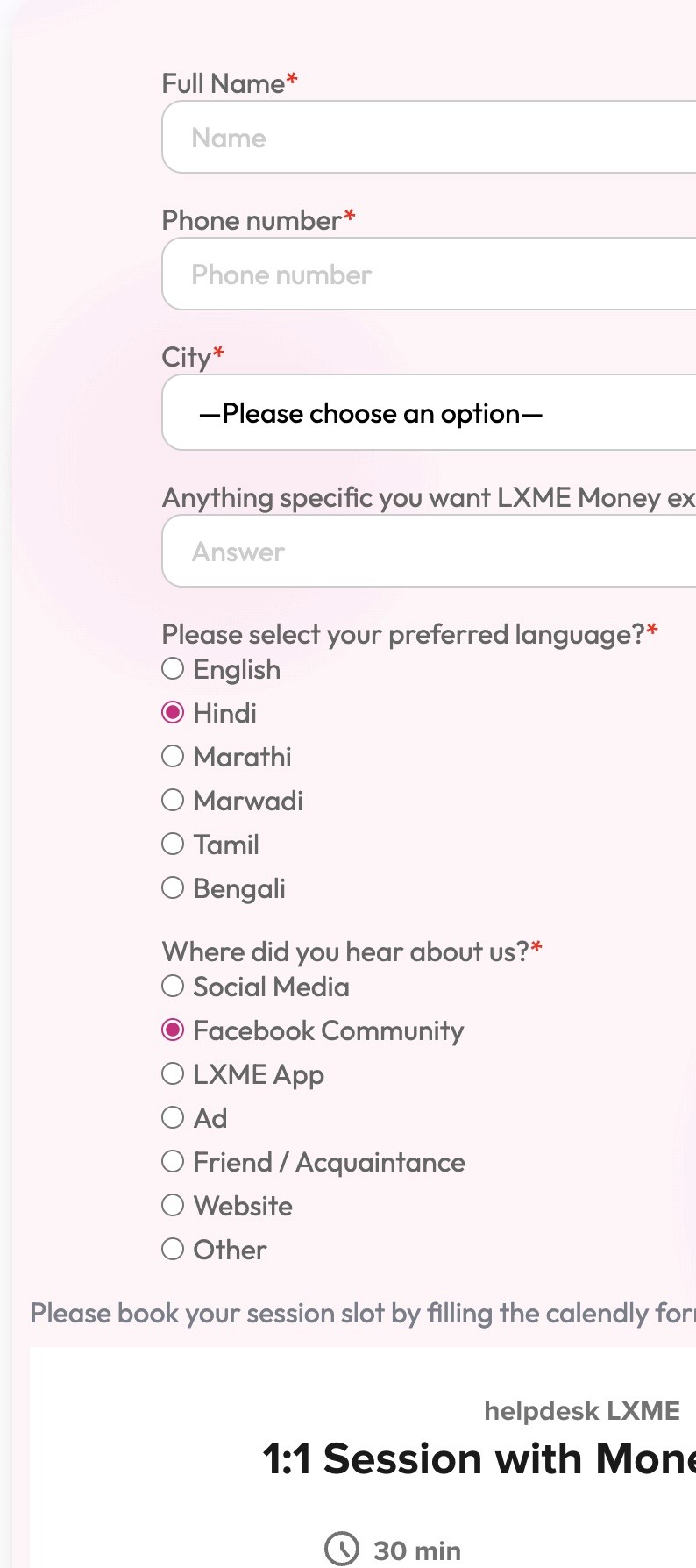

Introduced a transformative feature on LXME—a dedicated page where users can book one-on-one sessions with financial experts.

Introduced a transformative feature on LXME—a dedicated page where users can book one-on-one sessions with financial experts.

Introduced a transformative feature on LXME—a dedicated page where users can book one-on-one sessions with financial experts.

Overview

When I started working with LXME, it was in the early stages of addressing significant user engagement challenges on their financial platform for women.

What is the problem?

Users struggled to understand complex financial information, particularly those with little to no background in investments, leading to a lack of engagement in the platform.

What is the problem?

Users struggled to understand complex financial information, particularly those with little to no background in investments, leading to a lack of engagement in the platform

Through a combination of 1:1 interviews and an in-depth analysis of usage data and user behavior, we uncovered a key challenge faced by our primary audience—Indian women aged 35-65. Many of these women found it difficult to understand complex financial concepts and lacked the necessary guidance and support to begin their investment journey.

What is the Problem ?

Users struggled to understand complex financial information, particularly those with little to no knowledge, leading to a lack of engagement in the platform.

Through a combination of 1:1 interviews and an in-depth analysis of usage data and user behavior, we uncovered a key challenge faced by our primary audience—Indian women aged 35-65. Many of these women found it difficult to understand complex financial concepts and lacked the necessary guidance and support to begin their investment journey.

Hop on to my next project

Hop on to my next project

Hop on to my next project

Design solution #2

Design solution #2

Design solution #2

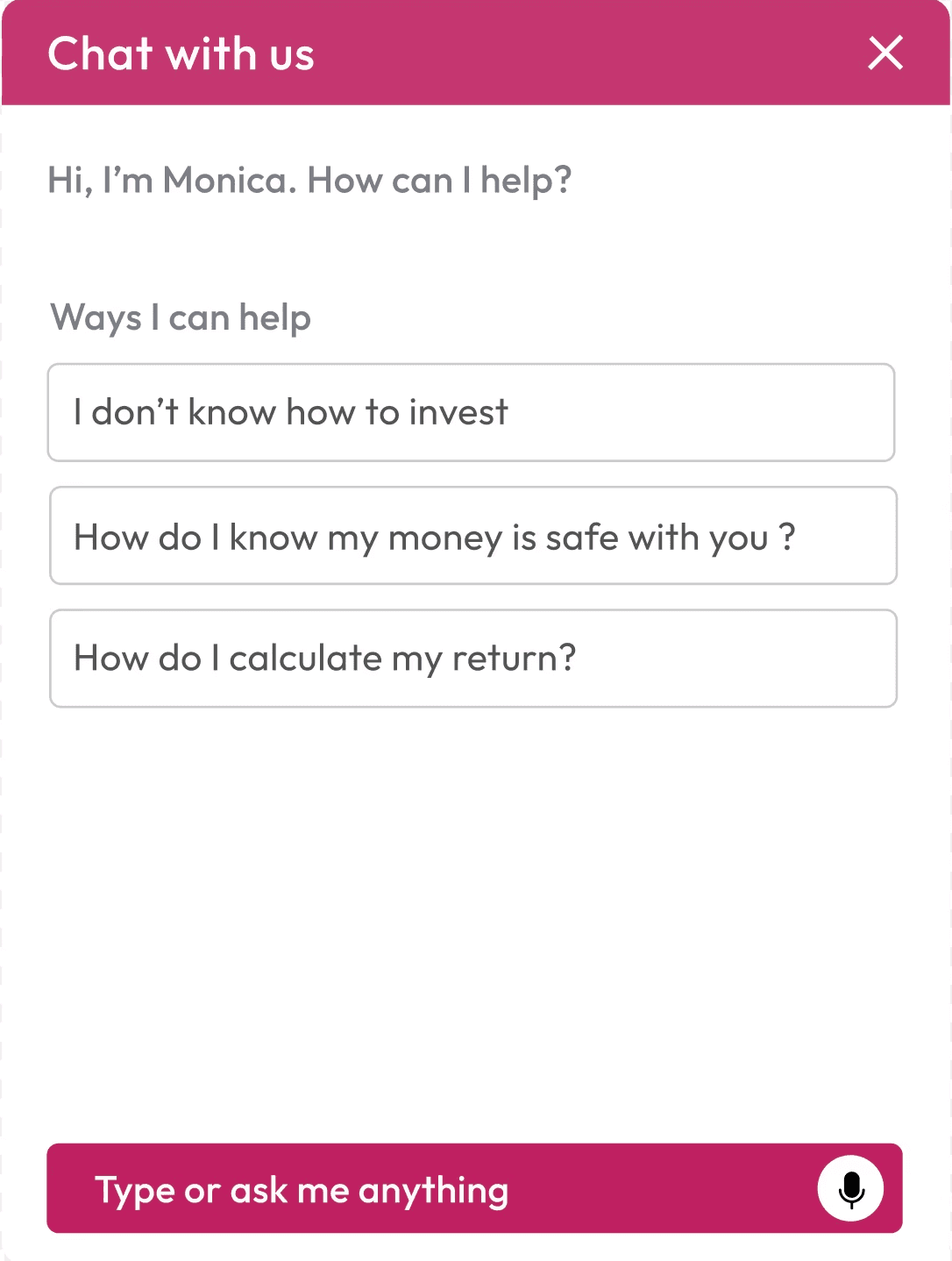

I A/B tested 2 versions of a feature innovation for providing personal guidance and support to women with financial guidance from experts.

I A/B tested 2 versions of a feature innovation for providing personal guidance and support to women with financial guidance from experts.

I A/B tested 2 versions of a feature innovation for providing personal guidance and support to women with financial guidance from experts.

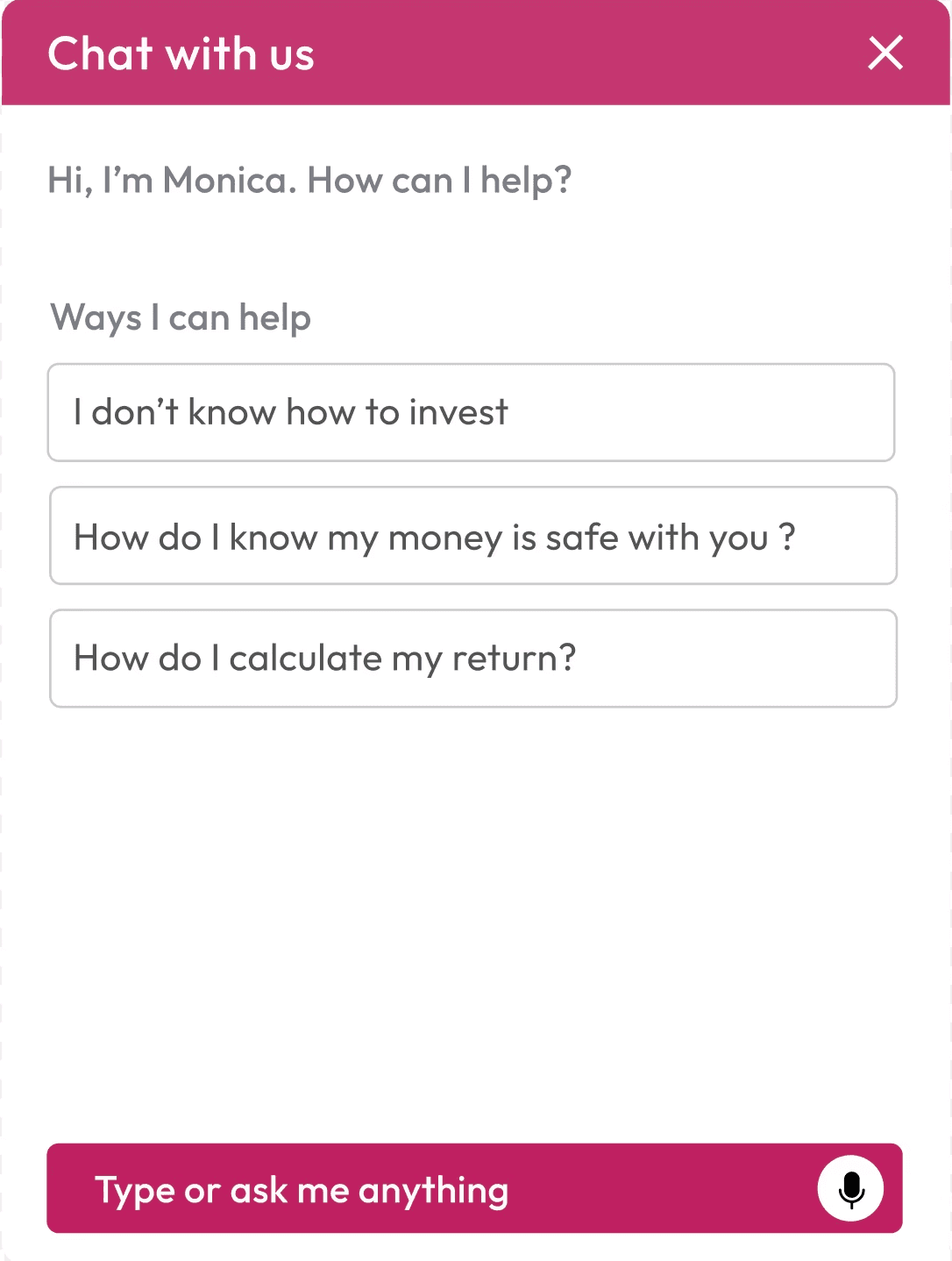

50% visitors see variation A

50% visitors see variation A

24/7 chatbot to provide instant, accessible user support and reduce wait times.

24/7 chatbot to provide instant, accessible user support and reduce wait times.

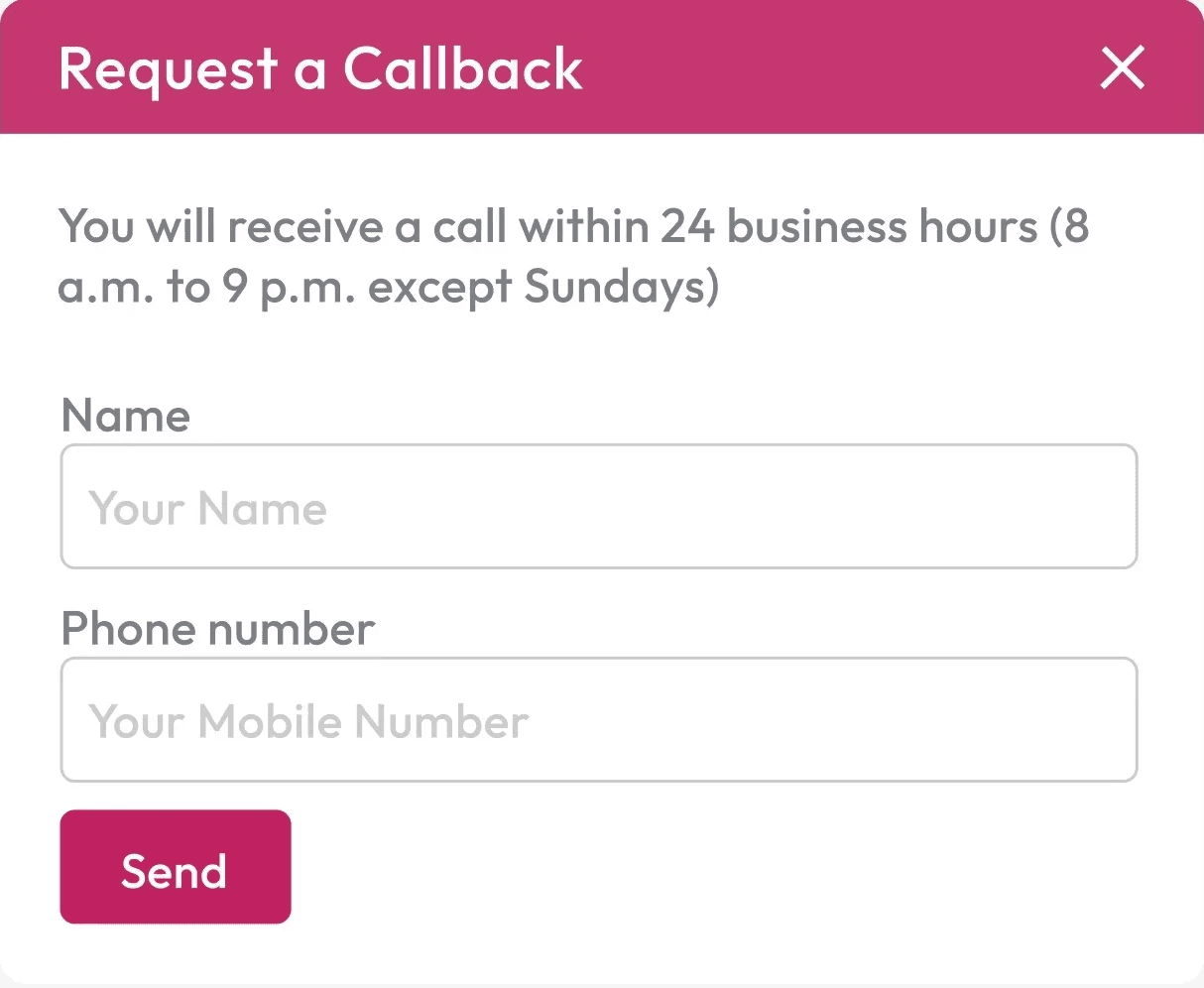

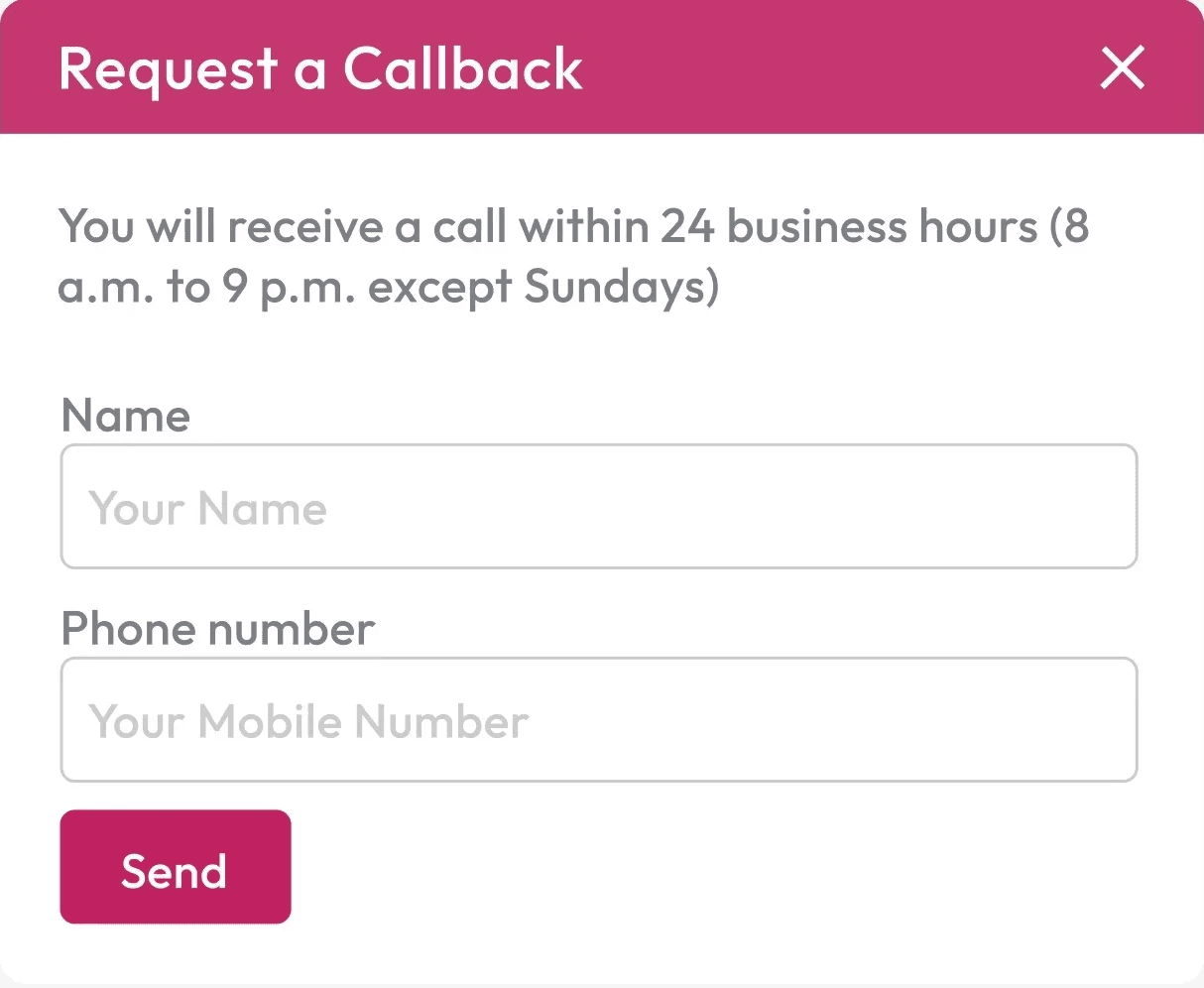

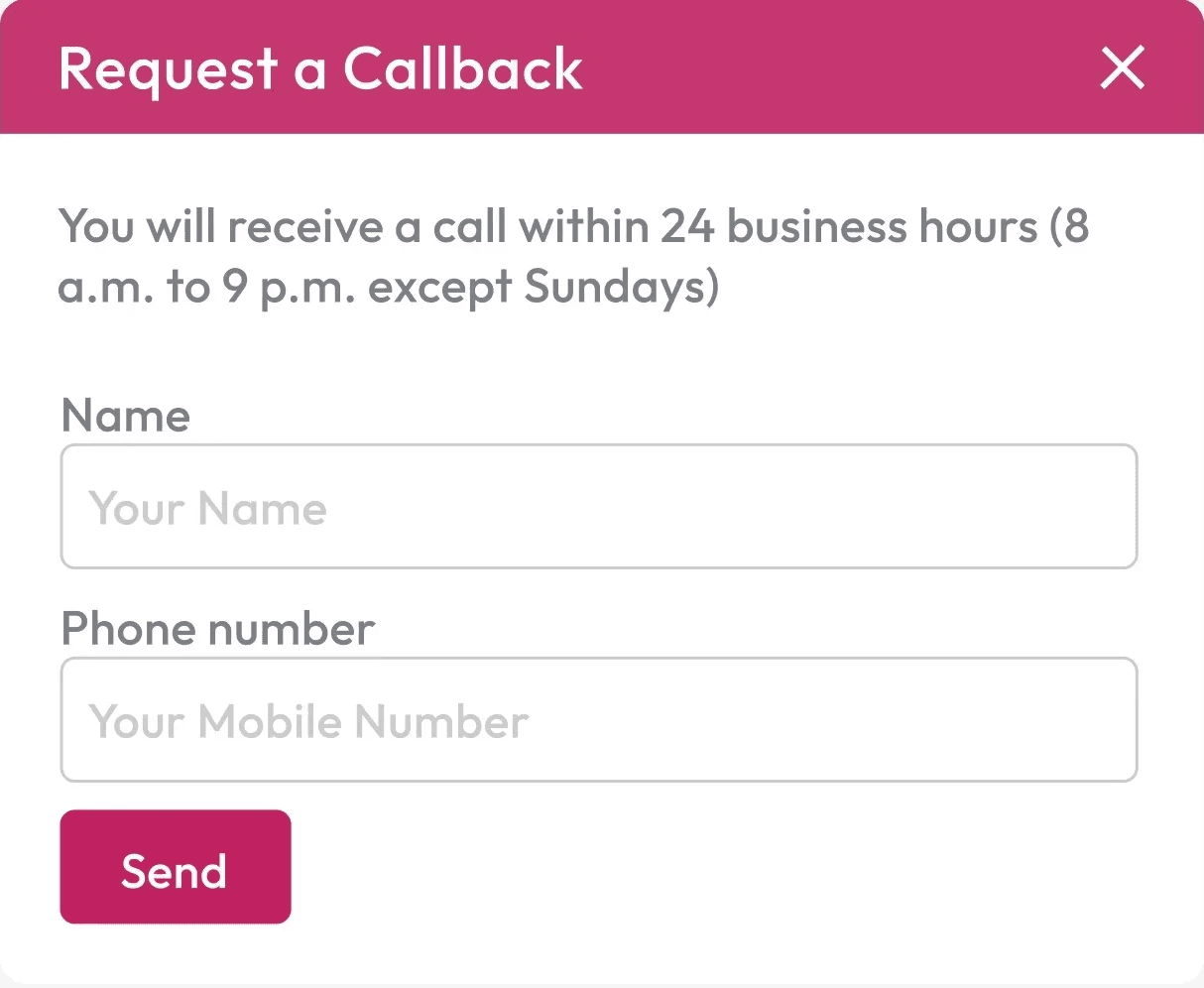

50% visitors see variation B

50% visitors see variation B

A callback feature for personalized expert assistance, reducing wait times and enhancing user security.

A callback feature for personalized expert assistance, reducing wait times and enhancing user security.

8%

Conversions

8%

Conversions

8%

Conversions

19%

Conversions

19%

Conversions

19%

Conversions

50% visitors see variation A

24/7 chatbot to provide instant, accessible user support and reduce wait times.

50% visitors see variation B

A callback feature for personalized expert assistance, reducing wait times and enhancing user security.

What solution did I propose?

What solution did I propose?

What solution did I propose?

Design solution #1

Design solution #1

Design solution #1

Localization encourages women across India to navigate the platform in their preferred language and understand the financial information.

Localization encourages women across India to navigate the platform in their preferred language and understand the financial information.

Localization encourages women across India to navigate the platform in their preferred language and understand the financial information.

The Solution

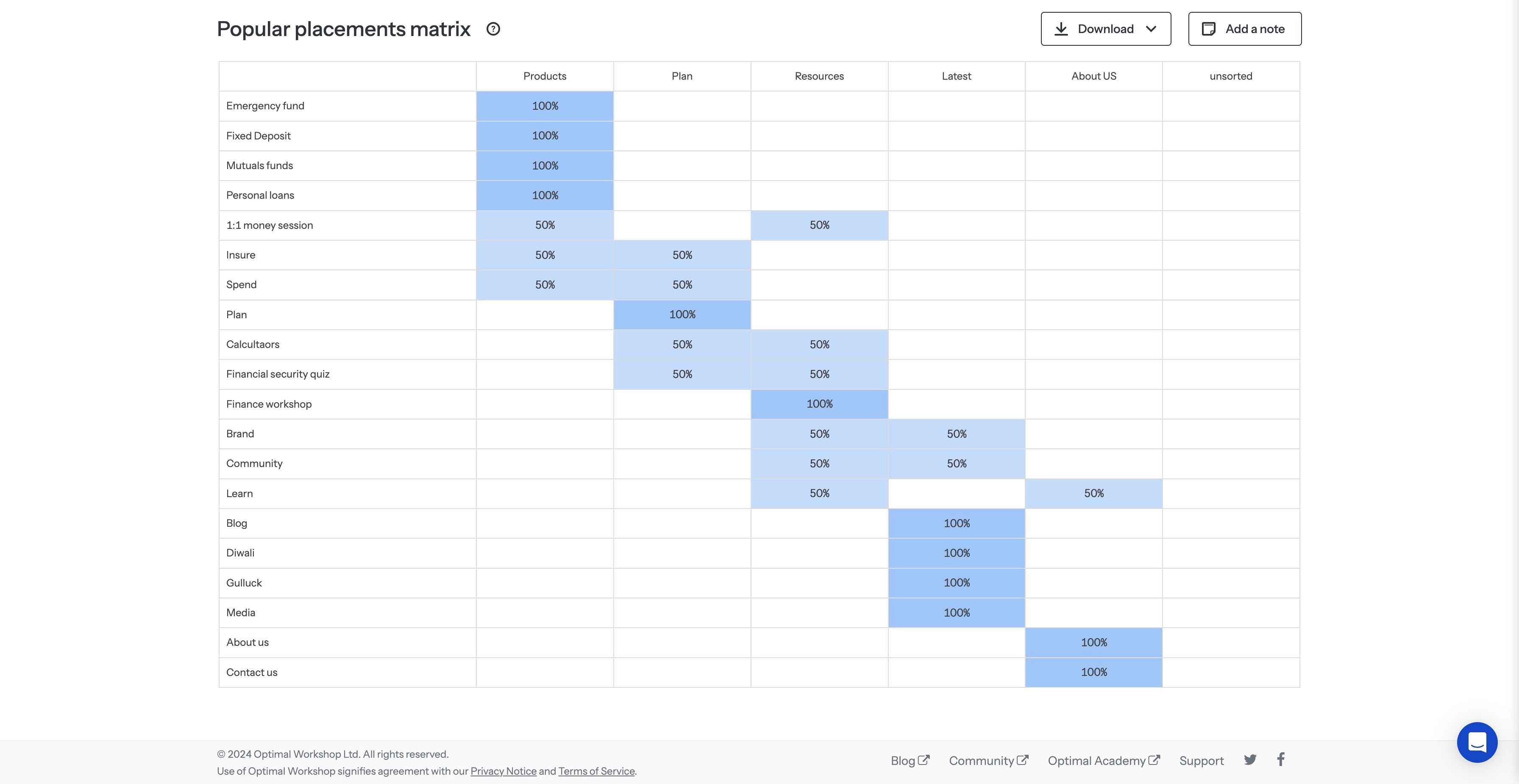

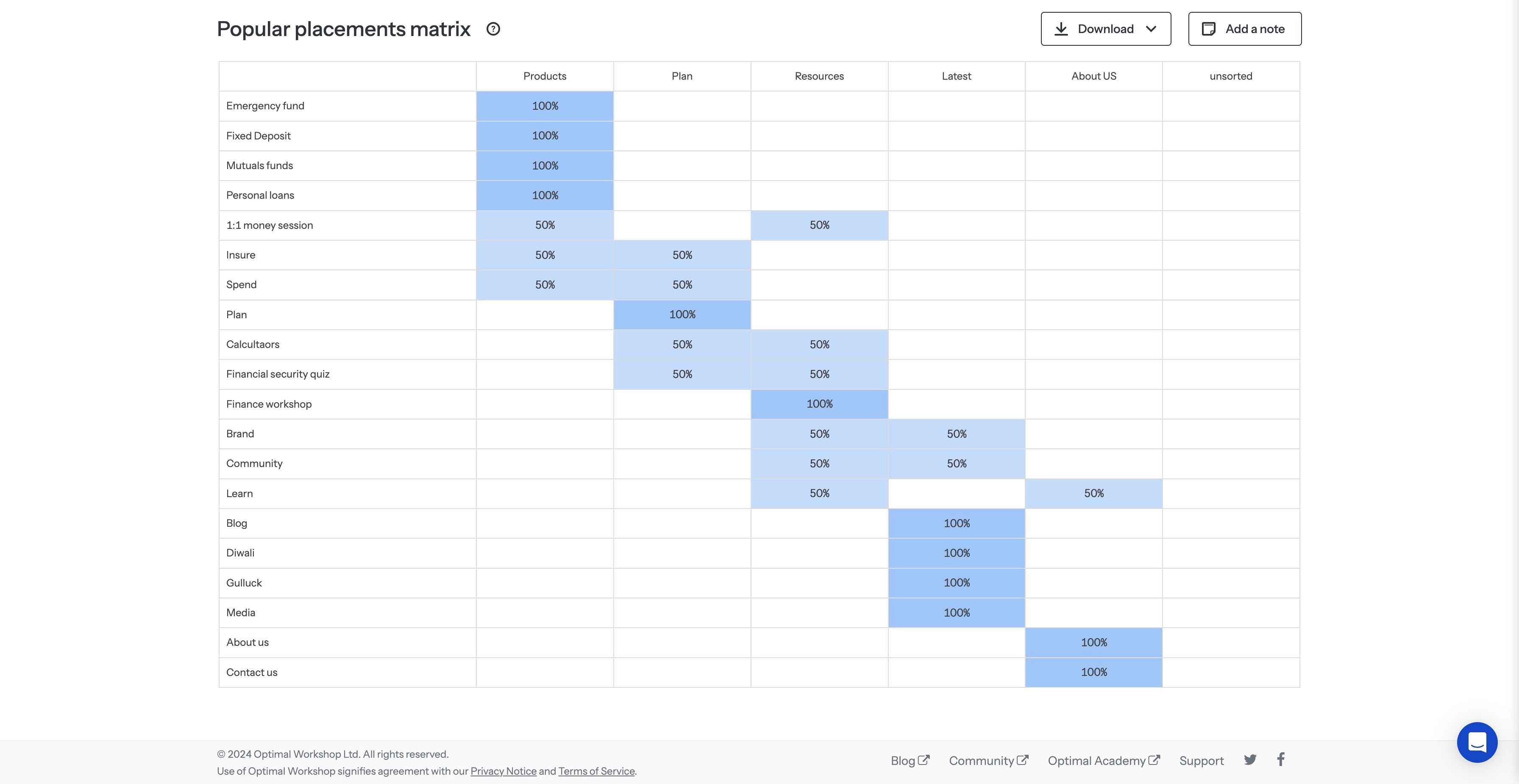

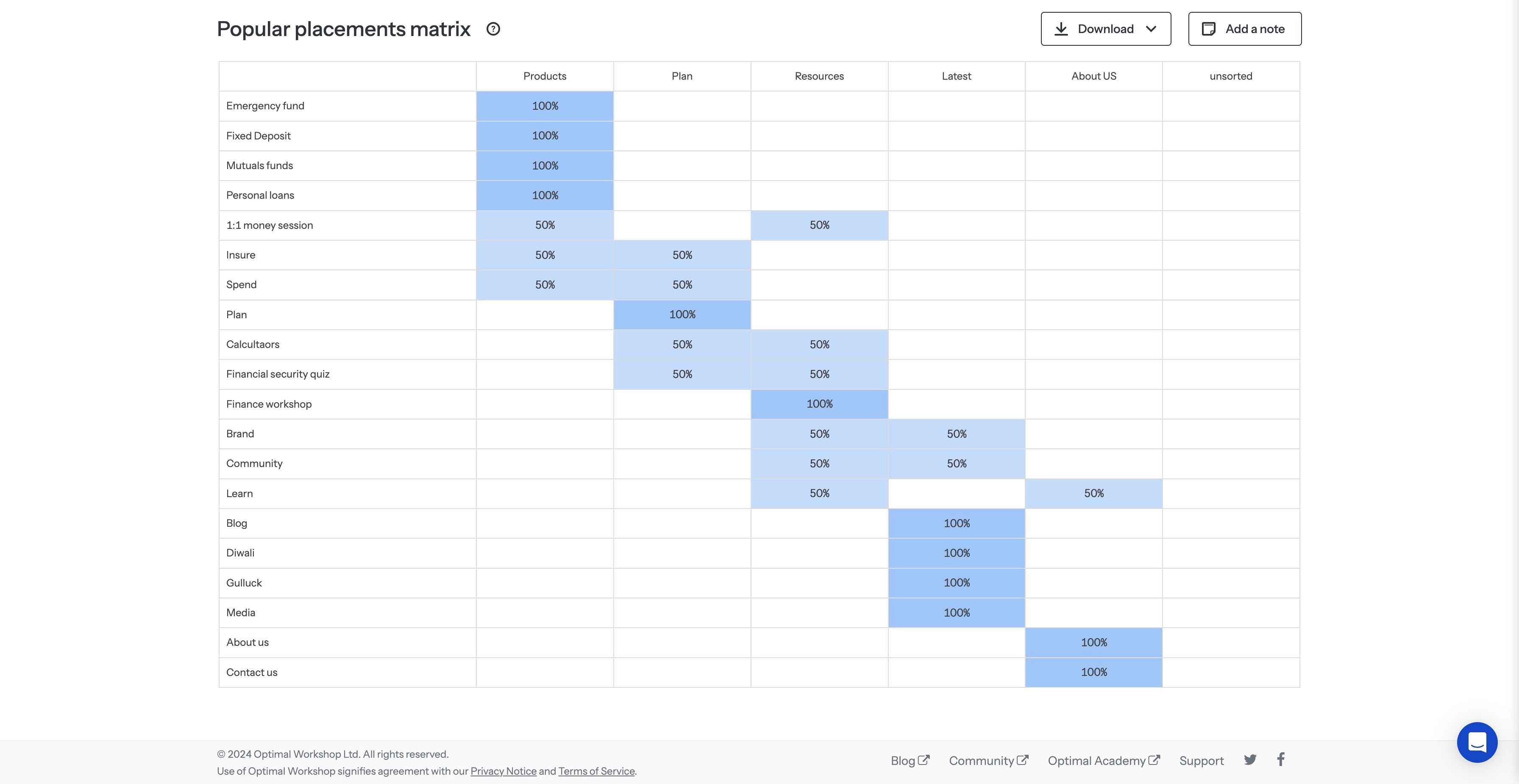

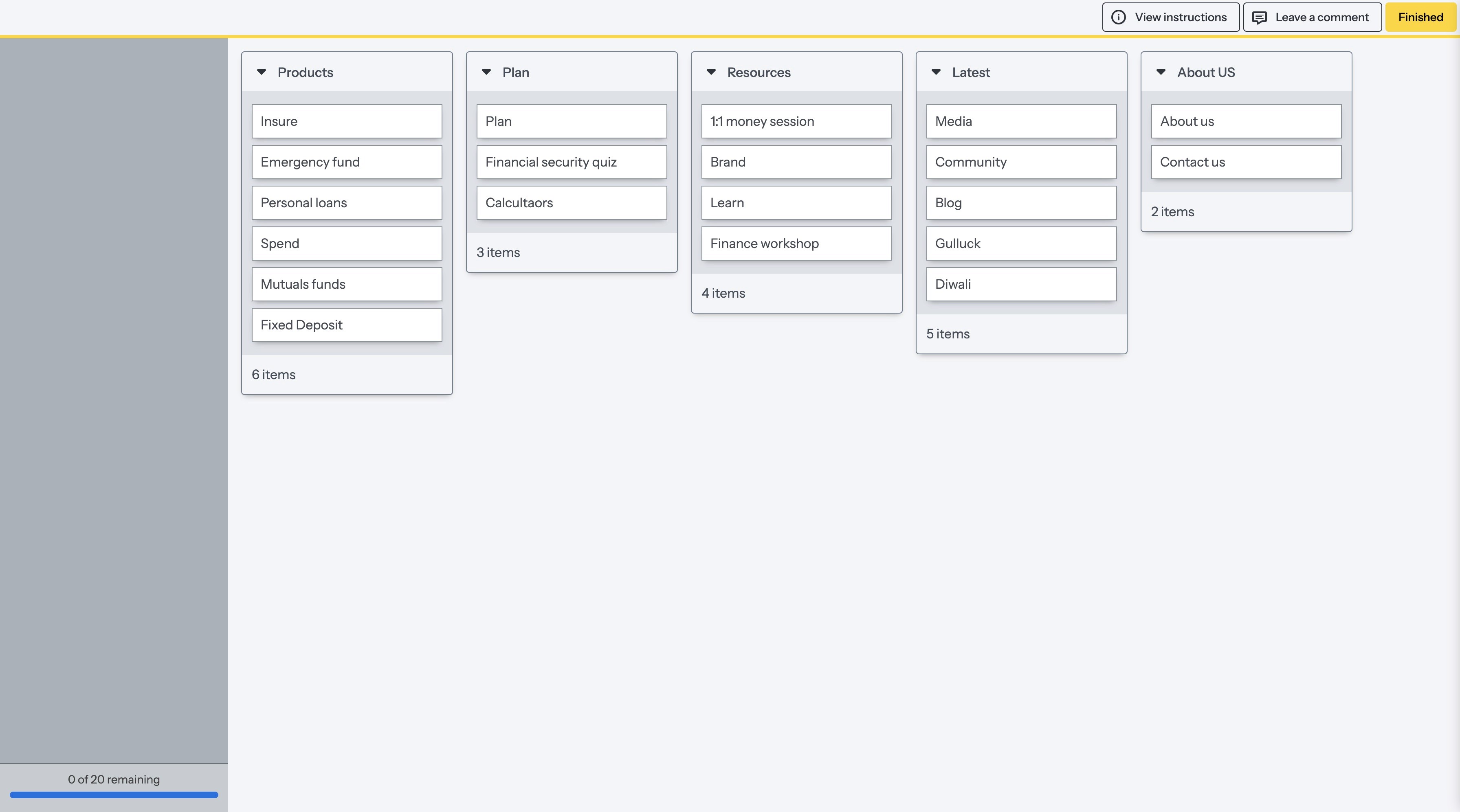

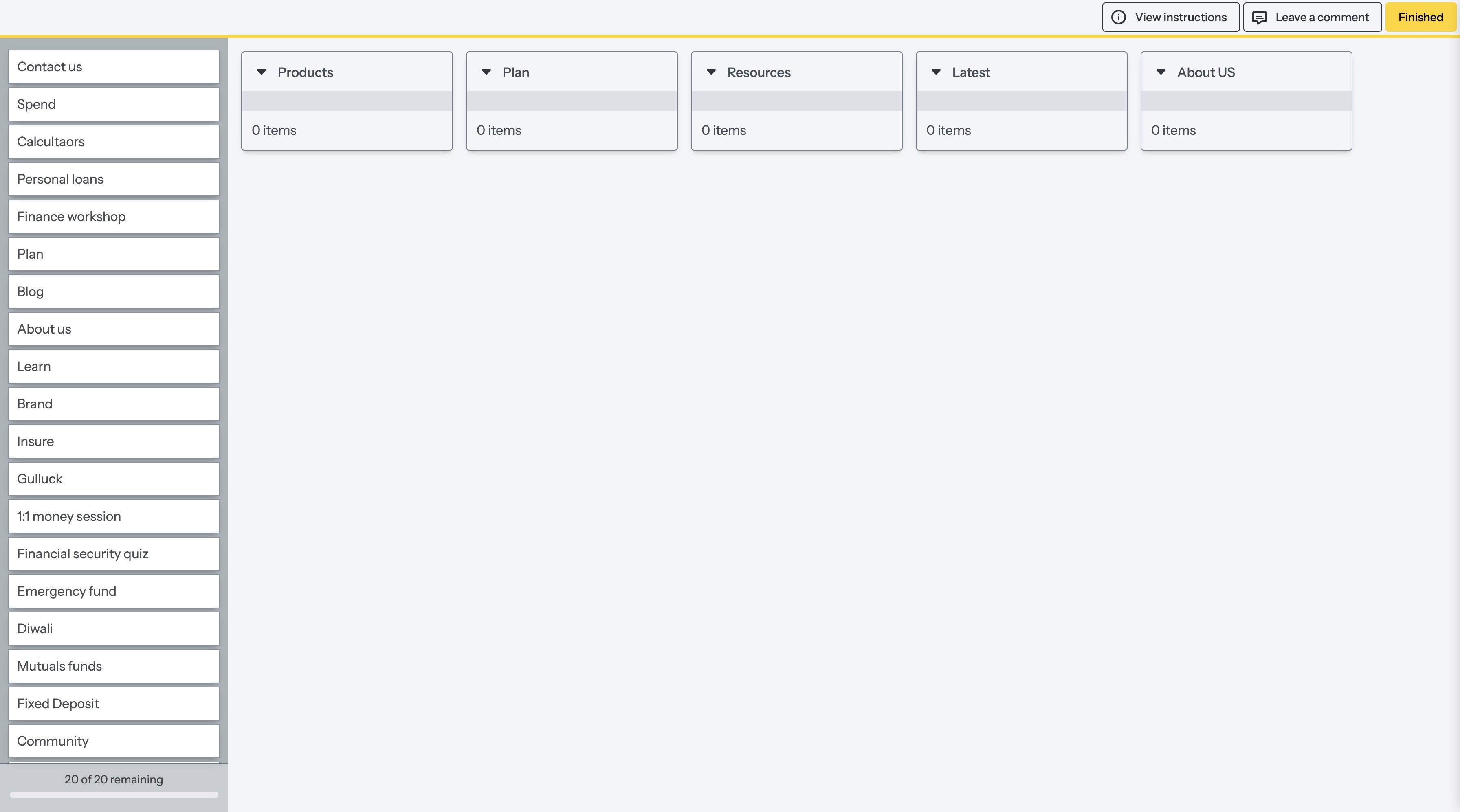

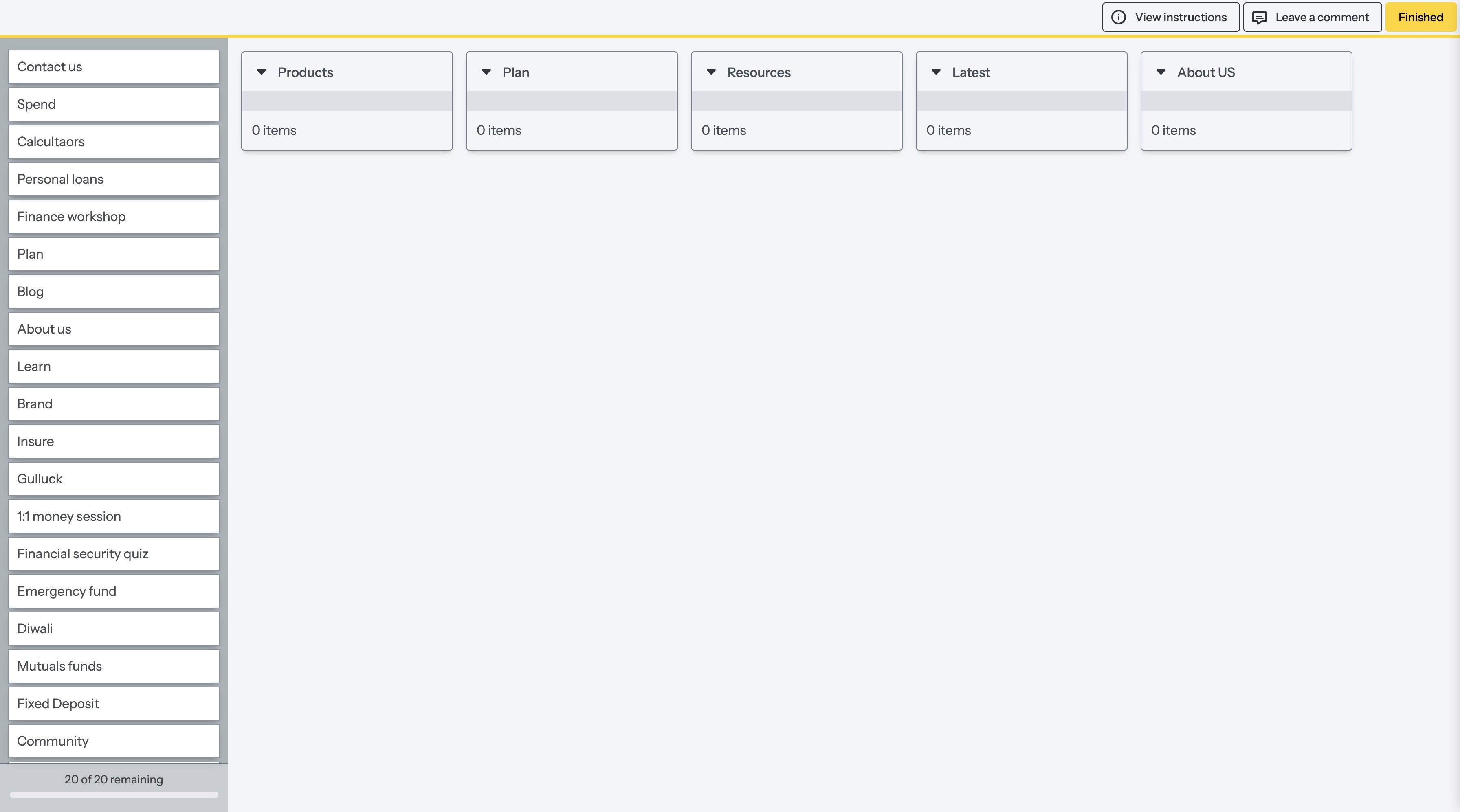

Card sorting and structure

Card sorting and structure

Card sorting and structure

The biggest problem we faced discovered from the research insights and data analysis was not being to find relevant information and navigate…

The biggest problem we faced discovered from the research insights and data analysis was not being to find relevant information and navigate…

The biggest problem we faced discovered from the research insights and data analysis was not being to find relevant information and navigate…

To better understand the structure from a user perspective we conducted a card sorting study where we recruited 20 participants to sort labels into categories and define the navigation structure according to their preference and needs.

To better understand the structure from a user perspective we conducted a card sorting study where we recruited 20 participants to sort labels into categories and define the navigation structure according to their preference and needs.

To better understand the structure from a user perspective we conducted a card sorting study where we recruited 20 participants to sort labels into categories and define the navigation structure according to their preference and needs.

Who are our users and what are their goals?

Who are our users and what are their goals?

Who are our users & what are their goals?

Based on my research insights I created two user personas to define pain points and goals of our target audience - Indian women aged 35 - 65

Based on my research insights I created two user personas to define pain points and goals of our target audience - Indian women aged 35 - 65

Based on my research insights I created two user personas to define pain points and goals of our target audience - Indian women aged 35 - 65

Meet Rani

Meet Rani

Meet Rani

Age 58

Mother, Homemaker

Financial Knowledge : Zero

Age 58

Mother, Homemaker

Financial Knowledge : Zero

Age 58

Mother, Homemaker

Financial Knowledge : Zero

Pain Points:

Overwhelmed by financial jargon

Difficulty understanding english

Struggles to find clear, relevant information

Goals:

Wants to understand savings options

Needs a simple, guided approach to

financial planning

Quote: “I just need something simple to

help me invest my savings”

Pain Points:

Overwhelmed by financial jargon

Difficulty understanding english

Struggles to find clear, relevant information

Goals:

Wants to understand savings options

Needs a simple, guided approach to

financial planning

Quote: “I just need something simple to

help me invest my savings”

Pain Points:

Overwhelmed by financial jargon

Difficulty understanding english

Struggles to find clear, relevant information

Goals:

Wants to understand savings options

Needs a simple, guided approach to

financial planning

Quote: “I just need something simple to

help me invest my savings”

Meet Sunita

Meet Sunita

Meet Sunita

Age 32

Single, Small business owner

Financial Knowledge : Intermediate

Age 32

Small business owner

Financial Knowledge : Intermediate

Age 32

Small business owner

Financial Knowledge : Intermediate

Pain Points:

Confused by complex investment options

Feels the platform lacks personalization

Doubtful of the platform's security

Goals:

Wants personalized guidance for her business

Find simple, trustworthy ways to

manage her finances.

Quote: “I need personalized guidance to

help me grow my savings”

Pain Points:

Confused by complex investment options

Feels the platform lacks personalization

Doubtful of the platform's security

Goals:

Wants personalized guidance for her business

Find simple, trustworthy ways to

manage her finances.

Quote: “I need personalized guidance to

help me grow my savings”

Pain Points:

Confused by complex investment options

Feels the platform lacks personalization

Doubtful of the platform's security

Goals:

Wants personalized guidance for her business

Find simple, trustworthy ways to

manage her finances.

Quote: “I need personalized guidance to

help me grow my savings”

Goal

Goal

Goal

How might we make financial planning simple and accessible for Indian women, especially those with little to no knowledge of investments?

How might we make financial planning simple and accessible for Indian women, especially those with little to no knowledge of investments?

How might we make financial planning simple and accessible for Indian women, especially those with little to no knowledge of investments?

01 Financial Literacy barriers

users struggled with complex financial terms, and showed low engagement, with only 18% interacting with educational tools.

How did I discover the problem?

How did I discover the problem?

How did I discover the problem?

Through a mixed-approach of user interviews and in-depth usage data analysis, I identified critical areas for improvement in the user experience

Through a mixed-approach of user interviews and in-depth usage data analysis, I identified critical areas for improvement in the user experience

Through a mixed-approach of user interviews and in-depth usage data analysis, I identified critical areas for improvement in the user experience

Analyzing user interactions and interviews revealed behavioral patterns. Examining key performance indicators (KPIs) helped us identify critical areas for enhancement. Merging qualitative and quantitative findings, I identified areas for improvement and designed solutions that simplified financial information, while providing guidance & support to the women making the platform more intuitive, secure and engaging for users.

Analyzing user interactions and interviews revealed behavioral patterns. Examining key performance indicators (KPIs) helped us identify critical areas for enhancement. Merging qualitative and quantitative findings, I identified areas for improvement and designed solutions that simplified financial information, while providing guidance & support to the women making the platform more intuitive, secure and engaging for users.

01 Financial Literacy barriers

01 Financial Literacy barriers

users struggled with complex financial terms, and showed low engagement, with only 18% interacting with educational tools.

users struggled with complex financial terms, and showed low engagement, with only 18% interacting with educational tools.

02 Lack of Trust in the Platform

02 Lack of Trust in the Platform

users expressed concerns about trusting LXME with their finances. Data analysis revealed a 35% drop off on the homepage.

users expressed concerns about trusting LXME with their finances. Data analysis revealed a 35% drop off on the homepage.

03 Language barriers

interviews indicated that language barriers impacted user engagement, supported by session lengths averaged only 1 minute 40 seconds.

04 Lack of guidance & support

users with no financial knowledge felt overwhelmed, only 10% of users interacted with the calendar feature for tracking financial goals.

What some of the women have to say based on the 1:1 interviews…..

What some of the women have to say based on the 1:1 interviews…..

What some of the women have to say based on the 1:1 interviews…..

04 Lack of guidance & support

users with no financial knowledge felt overwhelmed, only 10% of users interacted with the calendar feature for tracking financial goals.

03 Language barriers

interviews indicated that language barriers impacted user engagement, supported by session lengths averaged only 1 minute 40 seconds.

02 Lack of Trust in the Platform

users expressed concerns about trusting LXME with their finances. Data analysis revealed a 35% drop off on the homepage.

03 Language barriers

interviews indicated that language barriers impacted engagement, supported by session lengths averaged only 1 minute 40 seconds.

04 Lack of guidance & support

users with no financial knowledge felt overwhelmed, only 10% of users interacted with the calendar feature for tracking financial goals.

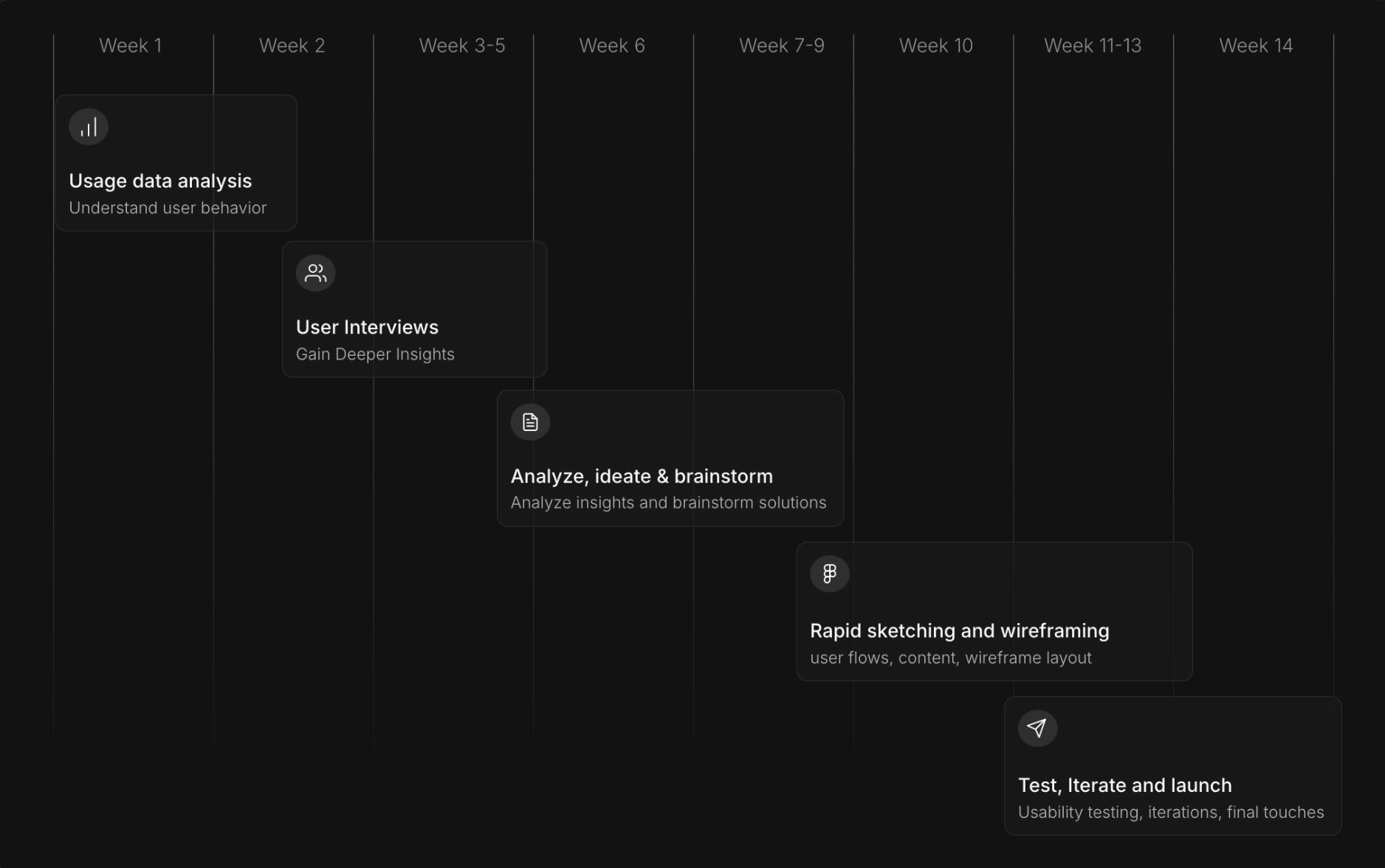

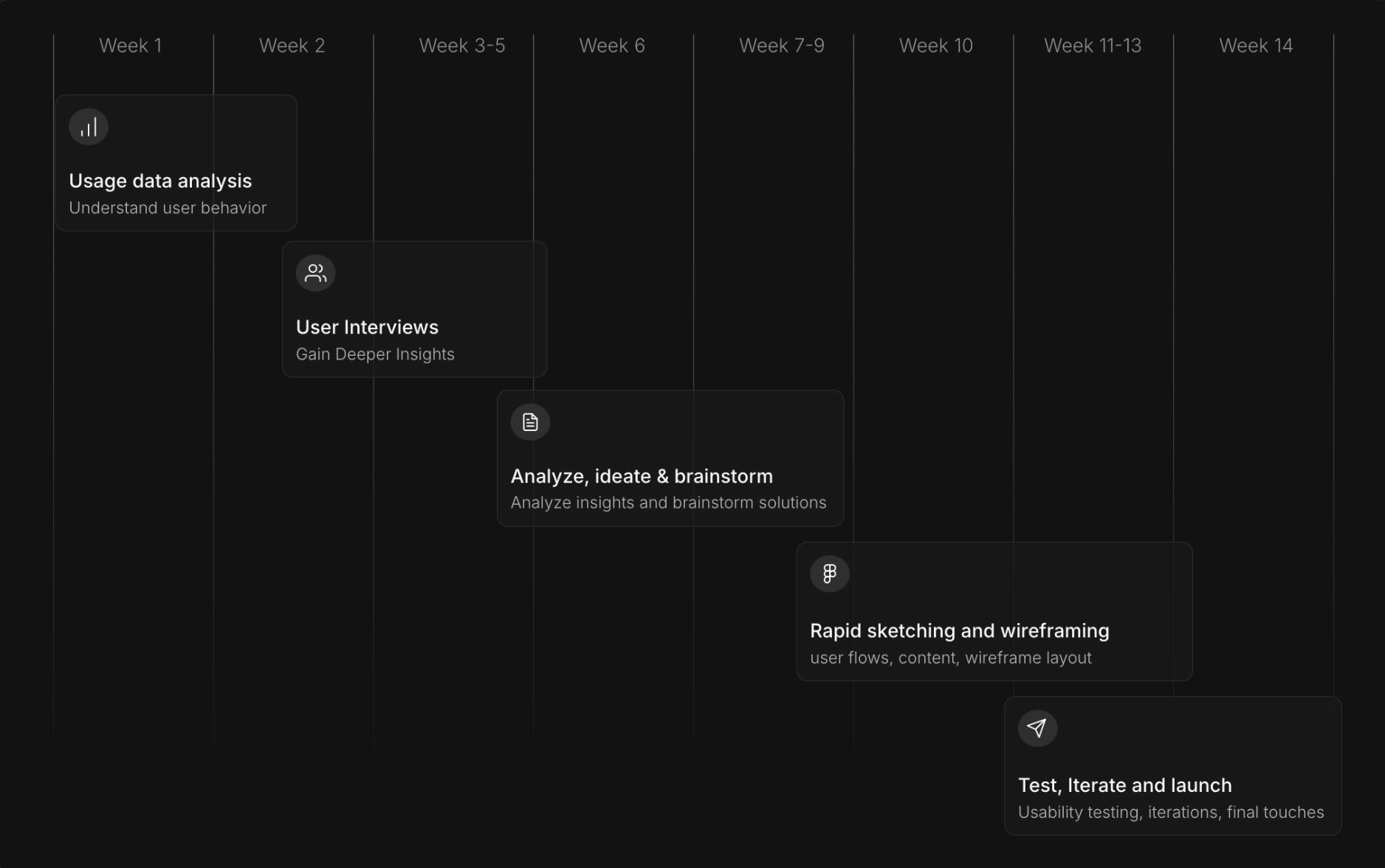

Week 1

Week 2

Week 3-5

Week 6

Week 7-9

Week 10

Week 11-13

User Interviews

Gain Deeper Insights

Analyze, ideate & brainstorm

Analyze insights and brainstorm solutions

Rapid sketching and wireframing

user flows, content, wireframe layout

Test, Iterate and launch

Usability testing, iterations, final touches

Week 14

Usage data analysis

Understand user behavior

Week 1

Week 2

Week 3-5

Week 6

Week 7-9

Week 10

Week 11-13

User Interviews

Gain Deeper Insights

Analyze, ideate & brainstorm

Analyze insights and brainstorm solutions

Rapid sketching and wireframing

user flows, content, wireframe layout

Test, Iterate and launch

Usability testing, iterations, final touches

Week 14

Usage data analysis

Understand user behavior

Week 1

Week 2

Week 3-5

Week 6

Week 7-9

Week 10

Week 11-13

User Interviews

Gain Deeper Insights

Analyze, ideate & brainstorm

Analyze insights and brainstorm solutions

Rapid sketching and wireframing

user flows, content, wireframe layout

Test, Iterate and launch

Usability testing, iterations, final touches

Week 14

Usage data analysis

Understand user behavior

The Process

The Process

The Process

Facilitated 200+ app downloads & Increased user session rate for LXME by 15%

Outcome - Facilitated 200+ app downloads & Increased user session rate for LXME by 15%

Highlight of the final redesign- Click on preview to navigate the shipped website

Highlight of the final redesign- Click on preview to navigate the shipped website

Highlight of the final redesign- Click on preview to navigate the shipped website

Timeline

Timeline

Timeline

Aug'21 - Nov'21

Aug'21 - Nov'21

Aug'21 - Nov'21

Team

Team

Team

2 UX Designers

3 Developers

1 Product Manager

1 Content Strategist

2 UX Designers

3 Developers

1 Product Manager

1 Content Strategist

2 UX Designers

3 Developers

1 Product Manager

1 Content Strategist

Tools

Tools

Tools

Figma, Miro, Optimal Workshop

Figma, Miro, Optimal Workshop

Figma, Miro, Optimal Workshop

My Role

My Role

My Role

Analyzed app usage data and UI audit

Conducted usability test and 1:1 interview

Designed early sketches and high fidelity prototype

Analyzed app usage data and UI audit

Conducted usability test and 1:1 interview

Designed early sketches and high fidelity prototype

Analyzed app usage data and UI audit

Conducted usability test and 1:1 interview

Designed early sketches and high fidelity prototype

Redesigned a women financial literacy platform

Redesigned a women financial literacy platform

Facilitated 200+ app downloads & Increased user session rate by 15%

Redesigned a women financial literacy platform

"I want to start investing, but I don't know where to begin. the information seems overwhelming for someone like me who has no knowledge about investing."

"I want to start investing, but I don't know where to begin. the information seems overwhelming for someone like me who has no knowledge about investing."

"I want to start investing, but I don't know where to begin. the information seems overwhelming for someone like me who has no knowledge about investing."

"I'm always hesitant to input my financial details online. How do I know it's really secure?"

"I'm always hesitant to input my financial details online. How do I know it's really secure?"

"I'm always hesitant to input my financial details online. How do I know it's really secure?"

"The financial terms used on the website are too complex. I wish there were simpler explanations I could refer to."

"The financial terms used on the website are too complex. I wish there were simpler explanations I could refer to."

"The financial terms used on the website are too complex. I wish there were simpler explanations I could refer to."

"I need more than just general advice. I want recommendations prefered to my financial situation."

"I need more than just general advice. I want recommendations prefered to my financial situation."

"I need more than just general advice. I want recommendations prefered to my financial situation."

"I want to be financially independent but I am not educated enough. I can hardly read english or understand financial terms."

"I want to be financially independent but I am not educated enough. I can hardly read english or understand financial terms."

"I want to be financially independent but I am not educated enough. I can hardly read english or understand financial terms."

What was the impact, and what did I learn?

What was the impact, and what did I learn?

What was the impact, & what did I learn?

Throughout this project, I contributed to planning and executing the end to end UX design process. Leveraging research insights, we crafted an intuitive platform tailored to the needs of Indian women, enhancing both usability and trust..

Throughout this project, I contributed to planning and executing the end to end UX design process. Leveraging research insights, we crafted an intuitive platform tailored to the needs of Indian women, enhancing both usability and trust..

Throughout this project, I contributed to planning and executing the end to end UX design process. Leveraging research insights, we crafted an intuitive platform tailored to the needs of Indian women, enhancing both usability and trust..

Increased user engagement by simplifying the interface and providing clearer, more accessible financial information, we saw a 30% increase in user engagement.

Increased user engagement by simplifying the interface and providing clearer, more accessible financial information, we saw a 30% increase in user engagement.

Increased user engagement by simplifying the interface and providing clearer, more accessible financial information, we saw a 30% increase in user engagement.

Boosted trust & platform adoption by focusing on addressing financial literacy and language barriers. As a result, we witnessed a 15% increase in new users.

Boosted trust & platform adoption by focusing on addressing financial literacy and language barriers. As a result, we witnessed a 15% increase in new users.

Boosted trust & platform adoption by focusing on addressing financial literacy and language barriers. As a result, we witnessed a 15% increase in new users.

Streamlined navigation and improved user flows to increase user session rates, allowing users to complete tasks like planning their savings or exploring mutual funds more efficiently.

Streamlined navigation and improved user flows to increase user session rates, allowing users to complete tasks like planning their savings or exploring mutual funds more efficiently.

Streamlined navigation and improved user flows to increase user session rates, allowing users to complete tasks like planning their savings or exploring mutual funds efficiently.

Broadened accessibility by introducing multilingual support, making it easier for users from diverse linguistic backgrounds to navigate and engage with the platform. This led to a notable increase in platform usage across various regions.

Broadened accessibility by introducing multilingual support, making it easier for users from diverse linguistic backgrounds to navigate and engage with the platform. This led to a notable increase in platform usage across various regions.

Broadened accessibility by introducing multilingual support, making it easier for users from diverse linguistic backgrounds to navigate and engage with the platform.

When I joined LXME Studio, it was in the early stages of addressing significant user engagement challenges on their financial platform for women.

Overview

What's the user story?

What's the user story?

What's the user story?

As a single mother, I want a simple financial app that is trustworthy and easy to understand, so that I can confidently manage my finances and save up for kids

As a single mother, I want a simple financial app that is trustworthy and easy to understand, so that I can confidently manage my finances and save up for kids

As a single mother, I want a simple financial app that is trustworthy and easy to understand, so that I can confidently manage my finances and save up for kids

Market Insight

Market Insight

Market Insight

80% of women in India struggle with financial literacy and around 62% of Indian women do not own bank accounts or have limited access to banking services.

80% of women in India struggle with financial literacy and around 62% of Indian women do not own bank accounts or have limited access to banking services.

80% of women in India struggle with financial literacy and around 62% of Indian women do not own bank accounts or have limited access to banking services.

The Solution

The Solution

Overview